If your Airbnb income looks great some months and suspiciously average the rest, it’s not the market—it’s the management.

Most Airbnb investors have the same quiet fear: “Is my place actually underperforming… or is this just how it is?”

Here’s the uncomfortable truth: many solid properties leave 20–30% of potential revenue on the table. Not because the market is bad, but because the strategy is half-finished.

The usual pattern looks like this: – Great photos (usually) – Casual pricing (“I just matched a few others nearby”) – Hit-and-miss housekeeping – No clear plan for low season, events, or last-minute bookings

The underlying problem? The property is being listed, not managed.

High-performing hosts think in systems, not stays.

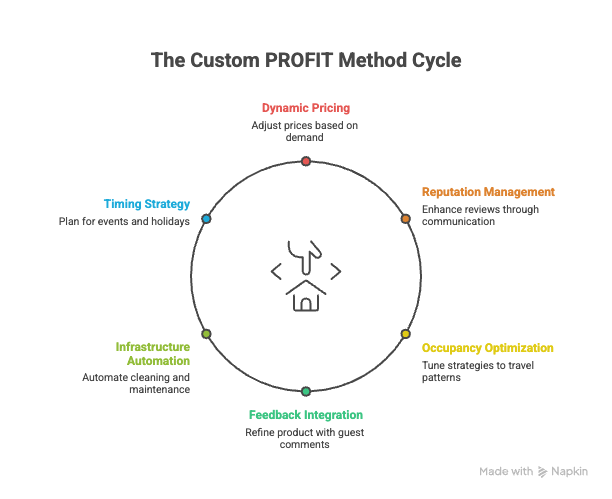

At Custom Bnb Hosting, we use a simple lens I call the PROFIT framework:

- P – Pricing: Dynamic pricing that moves with demand, not feelings.

- R – Reputation: Reviews engineered through great communication and small, memorable touches.

- O – Occupancy: Minimum stays, lead times, and calendar strategy tuned to your area’s travel patterns.

- F – Feedback: Using guest comments to refine the product, not take it personally.

- I – Infrastructure: Cleaners, maintenance, inventory and linen on autopilot.

- T – Timing: School holidays, long weekends, events and shoulder seasons planned well in advance.

When these pieces line up, investors see the shift: steadier occupancy, stronger nightly rates, fewer surprises, and a property that functions like a business, not a side project that interrupts dinner.

If you’re wondering whether your place could be working harder for you, you’re probably right. If you’d like a free, no-pressure performance appraisal and a few practical tweaks tailored to your property, we’re happy to take a look.